July 2025 Market Update Vlog

- Doron Weisbarth

- Jul 18, 2025

- 3 min read

Hi, I’m Doron Weisbarth with Weisbarth & Associates, and welcome to my July 2025 Market Update!

June gave us a market surprise that turned some heads —and this time, in a good way. After a sluggish and jittery spring—complete with stock market swings, economic uncertainty, and the announcement of new tariffs—King County’s housing market pulled a sharp move. Not only did the number of closed sales jump, but so did prices… especially at the high end. As always, the full story lives in the details, so let’s dig into the data.

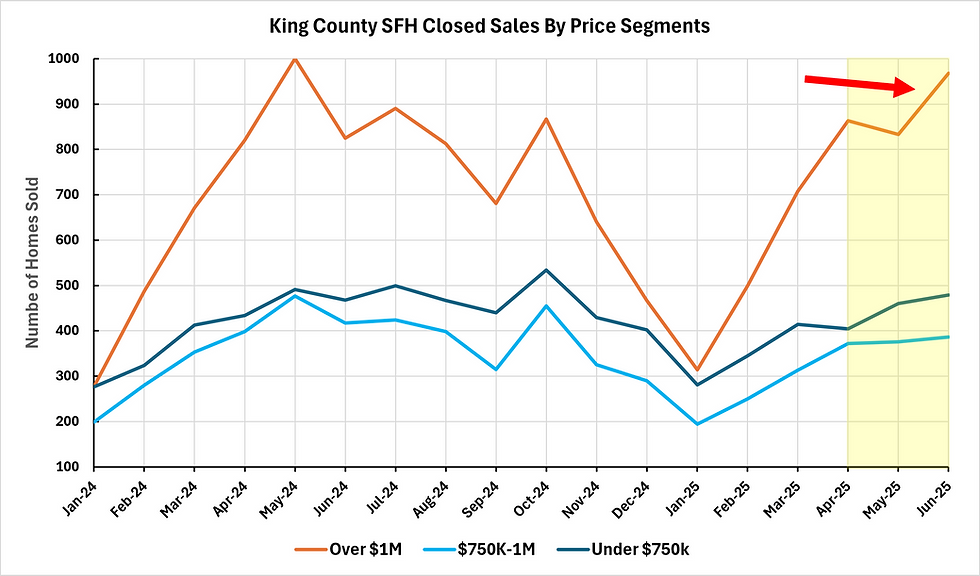

I was curious to see if there were any differences in market activity when looking at the data in three different segments of the market for single family home in King county.

This first chart shows the absorption rate in June—that’s the number of pending sales divided by new listings, which tells us how quickly the market is soaking up new inventory.

Across all three major price points—under $750k, $750k to $1M, and over $1M—the absorption rate rose by about 6%. Final rates were 65%, 66%, and 55% respectively. So while the increase was uniform, the high-end market is still moving more slowly overall.

But that’s not the whole story.

Here’s where it gets interesting. Take a look at this second chart showing the number of homes sold in each price bracket. Even though the high-end market had the slowest absorption, it still saw a noticeable jump in sales volume. It wasn’t a broad-based surge—it was a targeted burst of activity from high-end buyers who are often less affected by interest rates or market jitters.

And that’s what brings us to this third chart—median home prices by segment. You can see that prices rose most dramatically in the higher-end tier. So even though absorption was lower, that concentrated buying pressure on fewer premium homes pushed prices sharply higher. So it’s not that prices jumped across the board—it’s that a handful of heavyweight sales tipped the scales. Pretty wild, right?

Now, you might be wondering—with slower absorption and economic jitters—what’s keeping this market from tipping?

One key factor is the sharp drop in new listings, which fell 20% to 30% across all price tiers from May to June. That helped keep inventory from ballooning out of control—and in turn, supported pricing.

Another metric we track is what we call the demand ratio—pending sales relative to the total number of homes available for sale. That ratio stayed flat from May to June in all price segments, which tells us that while activity increased, the pace of listings declined enough to keep things in relative balance.

By the way, if you want to review all of these charts and explore the data at your own pace, you’ll find everything in my July newsletter—available online and for download, for free, at Weisbarth.com/newsletter. That’s Weisbarth.com/newsletter.

So what’s the takeaway?

The high-end market may be slower-moving, but it’s leading in price appreciation. And while overall buyer confidence isn’t quite where we’d like it to be, lower inventory and targeted demand are keeping this market resilient.

If you’re planning to buy or sell this year, strategy matters more than ever. My team and I will help you build a plan that fits the moment—no matter what kind of market we’re in.

And remember: when you work with us, you’re also supporting Akin, an amazing nonprofit helping kids and families in need thrive. Your real estate decisions are making a real difference in our community, and we’re so proud to be a part of that.

So if you’re ready to make a move—or if you’d like to refer someone—reach out. You can email, text, or use the contact info in the newsletter. But the best way? Just give me a call at 206-779-9808. That’s 206-779-9808. I love talking with new people and helping out.

Thanks for watching! Don’t forget to like, subscribe, and follow for more updates. And be sure to check out the full July newsletter at Weisbarth.com/newsletter.

I’m Doron Weisbarth with Weisbarth & Associates, enjoy this amazing weather, and I’ll see you next month.